| LFCF | Fund Inception Date | NAV/Share | Risk Level | Q4 2024 Return | 2024 Return | 2023 Return |

|---|---|---|---|---|---|---|

| Leno Financial Conservative Fund | July 2007 | $1.8818 | Low | +0.82% | +2.81% | +3.21% |

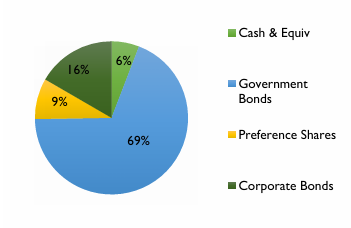

Leno Financial Conservative Fund (the “Fund”) is a fixed income fund that aims to provide a modest level of return while maintaining liquidity and preserving capital, mainly through investments in Government Bonds, high-quality corporate securities, and term deposits. The Fund seeks to maintain a Net Asset Value that provides its Shareholders stable, low-risk returns.

The Fund invests predominantly in Bahamas Government bonds and a diversified portfolio of bank deposits, corporate bonds, and preference shares. Its emphasis is on principal protection and maintaining high credit quality. The portfolio carries a low level of risk to the Investor and provides capital preservation while generating a reasonable yield.

The Leno Financial Conservative Fund is invested in assets that present a lower level of risk. However, with this lower level of risk comes lower levels of expected return from this strategy. Its invested assets typically consist of fixed-income investments such as government registered stock and corporate bonds.

5%-7%

| Investment Manager | Analysis Period | ||||

|---|---|---|---|---|---|

| Leno Asset Management Ltd. | October 1, 2024 – December 31, 2024 | ||||

| Benchmark | |||||

| 50% Markit iBoxx USD Liquid Investment Grade Index + 50% Bloomberg Barclays U.S. Aggregate Float Adjusted Index | |||||

| Performance | Qtr-4 | YTD | 1 YR | 3 YR | Since Inception |

| Fund | -1.91% | +0.10% | +0.10% | -1.82% | -0.28% |

| Benchmark | -3.55% | +1.18% | +1.18% | -2.82% | +3.64% |

| +/- Benchmark | +1.64% | -1.08% | -1.08% | +1.00% | -3.92% |