| LFBF | Fund Inception Date | NAV/Share | Risk Level | Q4 2024 Return | 2024 Return | 2023 Return |

|---|---|---|---|---|---|---|

| Leno Financial Global Bond Fund |

July 2007 | $0.9689 | Medium | -1.91% | +0.10% | +1.92% |

Leno Financial Global Bond Fund (the “Fund”) is a fixed income fund that aims to provide the highest possible level of return while maintaining liquidity and preserving capital, primarily through investments in USD fixed-rate investment-grade instruments. The Fund seeks to maintain a Net Asset Value that provides stable returns to its Shareholders.

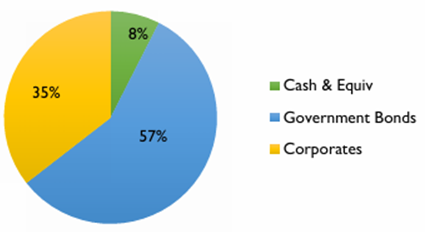

The Fund invests in investment-grade USD-denominated bonds issued by countries and corporate entities. Its emphasis is on principal protection with a degree of growth. The Fund’s portfolio generates a steady flow of reinvested interest income. The portfolio carries only investment-grade credit risk and aims to reduce interest rate risk by holding a bond portfolio with a medium-term duration.

Leno Financial Global Bond Fund provide B$ investors with exposure to USD investments. This fund is attractive to those employees that are risk averse and/or employees approaching retirement and wish to preserve capital.

5%-7%

| Investment Manager | Analysis Period | ||||

|---|---|---|---|---|---|

| Leno Asset Management Ltd. | October 1, 2024 – December 31, 2024 | ||||

| Benchmark | |||||

| 50% Markit iBoxx USD Liquid Investment Grade Index + 50% Bloomberg Barclays U.S. Aggregate Float | |||||

| Performance | Qtr-4 | YTD | 1 YR | 3 YR | Since Inception |

| Fund | -1.91% | +0.10% | +0.10% | -1.82% | -0.28% |

| Benchmark | -3.55% | +1.18% | +1.18% | -2.82% | +3.64% |

| +/- Benchmark | +1.64% | -1.08% | -1.08% | +1.00% | -3.92% |